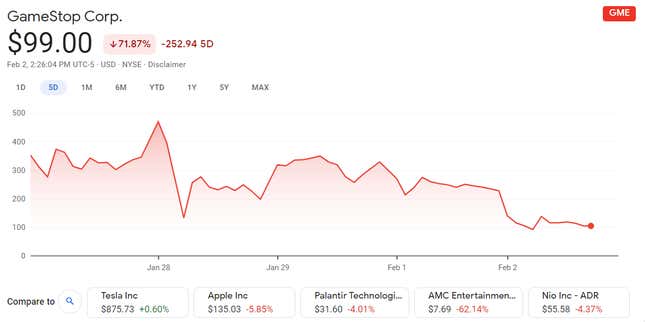

After soaring for more than a week, GameStop’s stock has plummeted back down to earth, sinking below $100 a share several times today, a drop-off of more than $200 from last week.

The freefall comes after an already rocky time yesterday that saw the meme stock steadily decline throughout the day. Now its fall appears to be picking up speed, especially as Bloomberg reports that short sellers, one of the things fueling the stock’s unlikely rise, have been bailing.

The stock could still rally again, though that seems unlikely, especially in the long run. The market for physical games continues to be not great, and even if GameStop stock settles in at a stable price higher than last year’s, the Reddit circus that helped propel the company’s valuation up from $1 billion over $20 billion looks like it’s finally winding down. Meanwhile, people over on WallStreetBets are still desperately trying to reassure one another that the end is not in fact in sight, and they should still hold onto their stock.

Billionaire Mark Cuban took to a Reddit AMA earlier today to egg the day-traders puffing up GameStop and other meme stocks. “I have no doubt that there are funds and big players that have shorted this stock again thinking they are smarter than everyone on WSB,” he wrote. “I know you are going to hate to hear this, but the lower it goes, the more powerful WSB can be stepping up to buy the stock again.”

That might be fine advice for deeply pocketed investors looking to thumb their noses at Wall Street, but it’s dangerous for anyone investing money they can’t afford to lose. Every bubble pops eventually. Now it’s just a question of how many average people who took up trading meme stocks based on a whim and the hype surrounding the stock market get hurt in the process. Hopefully not many.